India: Where Does the National Profit Flow to? An Observation on Foreign Investment and Trade in India 1949-2003

In recent years, India’s high GDP growth has attracted global attention. It seems that it is inevitable that India is becoming a great power. However, does high GDP growth rate necessarily mean a sustainable development of Indian economy? The author carefully examines the statistics of foreign investment and trade in India since the country gained independence nearly six decades ago. He pointed out that India’s national economy has been heavily relying on foreign capital, foreign trade deficit has been staying at a high level, and the country was incapable of accumulating wealth effectively. All these factors hindered the sustainable development of Indian economy. Economic development shows path-dependent features, and previous economic figures can somehow showcase India’s existing structural problems. Thus, India’s successful rise still faces great challenges and poses thought-provoking questions.

Some people may ask these age-old questions: Why India, which has been witnessing fast-growing GDP growth rate in recent years and accumulated considerable national wealth, didn’t see any progress with poverty alleviation? Why India, after developing for more than half a century, still has such a large poverty-stricken population? As for the question “Where did the increased income go?” raised by India’s first Prime Minister Jawaharlal Nehru (1889-1964) in 1960, people still need to search for answers today.

Research on India’s economic structure and corresponding allocation structure reveals that except necessary accumulation for agricultural and industrial reproductions, the basic living allowances provided to the poor by the government, and public expenditure such as defense spending, a large proportion of India’s annually increased profits goes to developed countries in the West, through asymmetric foreign trade and regurgitation-feeding with these countries.

India’s enormous poverty-stricken population led to the continuous shrinking of its domestic market, which compelled the country’s large capitals to seek and rely on overseas markets and international capitals. As a result, a profit-exporting pipeline, which was virtually a profit reverse cycle with international capital centers, has been installed in the Indian national economy. And, India’s departments of foreign capital and trade served as the major players to push forward this profit reverse cycle process.

Capital’s globalization process divided the world into two parts: the capital center and capital periphery. For countries belonging to the latter group, if they want to achieve independent development and don’t want to follow the practice of some socialist countries such as the former Soviet Union and China, which eliminated private ownership, withdrew from the world capital system temporarily, and developed in a comparatively enclosed environment, they are often faced with fatal difficulties on capital and foreign exchange shortages at the initial phrase of their modernization.

To solve the problem, one solution is to simplify property rights structure. In this way, property transactions cost, which is included in the price of products, will be reduced. With reduction in domestic consumption, increase in export, and restricted import of consumer goods, the income of foreign exchange will steadily increase and the abilities to purchase and absorb foreign technological products will be enhanced. However, this practice can easily be carried out in countries with simple property right structures, with public ownership as the mainstay.

There is another solution. Since private ownership remains and cost of social revolution, therefore, is reduced, development cost has thus increased. To resolve the abundant disputes over private property rights, massive money supply is required, resulting in the dependence on international finance. Understandably, national economy will be easily trapped by the double snare of international debt and external deficit.

If the domestic market is small and continues to shrink, the national economy will depend more on international capital, resulting in the profit-reverse cycle relationship with international capitals as the major profit gainers. In this relationship, the development of a nation becomes exactly the factor that hampers its development.

Dependence on Foreign Capital

After it gained independence in 1947, India began to accept external financial aid, with the aim of covering the deficiency of domestic savings, generating foreign exchange earnings, and increasing technology import. With the rise of investment rate, India’s foreign exchange expenditure increased, which quickly exceeded the country’s fiscal capacity. Beginning from 1972, India has been facing serious foreign exchange crisis. Thus seeking foreign aid has, in a way, hampered the country’s development.

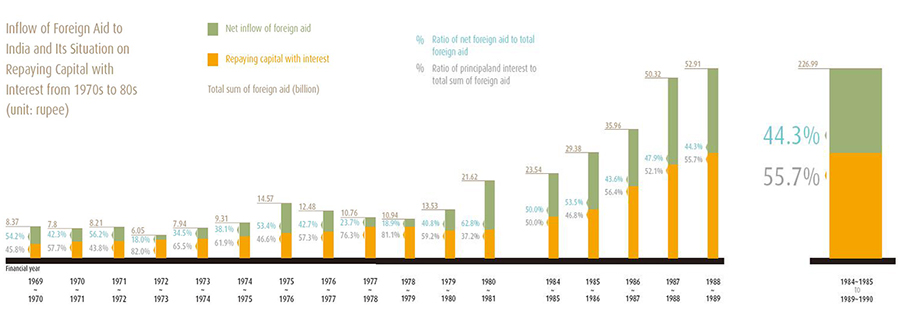

Improper use of financial aid can easily lead to foreign debts. Statistics from the chart below reveal that financial aid had gradually become a kind of burden for India. In the 1972-73 and 1978-79 financial years, India’s repaying capital with interest accounted for more than 80 percent of its foreign aid, resulting in decreases of net foreign financial aid on year-on-year basis. Of all the 18 financial years listed in the chart, in 14 years, India’s repaying capital with interest surpassed half of the total sum of foreign aid. From 1969 to 1989, while the total inflow of net international aid to India has increased, its proportion in India’s foreign aid has dwindled, from 54.2 to 44.3 percent. And, of India’s external debts, about one thirds was repaid as interest.

From 1990 to 2003, inflow of foreign capital to India already exhibited distinct features of profit-reverse cycle. The ratio of the total sum used to repay debt in the total foreign aid sum soared to around 80 percent from the previous 68 percent. During the same period, the ratio of net inflow of total foreign aid plunged from 32 to 20.7 percent. These facts indicated that the foreign aid India received annually no longer played a positive role, but became debt burden gradually.

From the very beginning, India’s modernization moves ahead with high exploitation by international capital. Due interest, which accounted for half of its debt and was always required to be repaid on time, greatly weakened the effect of the foreign aid India received.

Increased amount of interest is the result of India’s demand on high-interest commercial loans. From 1991 to 2003, the medium-and-long-term governmental foreign loans India received increased by 2.1 times, while non-governmental loans increased by 4.2 times, and commercial loans increased by 4.4 times, which were all high-interest debts without favorable terms.

It is worth noting that since India carried out its first nuclear test in 1974, loans to India from International Monetary Fund (IMF) stopped abruptly, leading to a sharp rise of India’s commercial borrowings. The phenomenon indicated that under international political pressure, instead of becoming more independent, India’s international dependence became even greater and addictive.

The Core of Trade Deficit

India’s foreign trade is another sector that pushed forward the country’s profit-reverse cycle.

After it gained independence in 1947, India’s land reform failed. Constrained by backward production relations, India’s agriculture experienced ongoing shrinking. Decline in agricultural production further restricted its industrial market. As a result, India began to import a large number of industrial products from the West. However, since its industrial productivity had been constrained by the gradually shrinking domestic market, India also failed to absorb Western technologies. Thus, primary commodities with low additional value constituted a major part of India’s exports, resulting in a skyrocketing trade deficit and a degrading status in international trade.

Shortly after India gained independence, the country began to face chronic trade deficit, and foreign exchange, which was in great need then, witnessed shortage. Beginning from 1966, India began to implement its annual plan. In June of the same year, India devalued its currency by 36.5 percent to boost export. Almost at the same time, the government announced a free-import policy which would be implemented in 59 sectors, but the situation hadn’t been improved. From 1965 to 1967, India’s trade deficit soared to 9.21 billion rupees from the previous 5.99 billion. The 1968-69 financial year witnessed a harvest, which led to a cut-down on grain import and a significant decrease on trade deficit. The 1972-73 financial year saw India’s first trade surplus of 1.04 billion rupees since its independence. The 1976-1977 saw another trade surplus, but only with 680 million rupees. In the 1978-79 financial year, the last year of India’s fifth five-year plan, the international oil crisis made India’s trade deficit rise further. The situation propelled the Indian government to apply huge loans from IMF, but its trade situation continued to deteriorate. Since then, India’s trade deficit has been out of hand, surging from 27.25 billion rupees in the 1979-80 financial year, the first year of India’s sixth five-year plan, to 420.69 billion rupees in the 2002-03 financial year, In particular, during the 53 years from 1950 to 2003, India’s foreign trade only saw favorable balance in two years, an unbelievable “miracle” in the economic development history of the world’s major countries. This situation cannot be reasonably explained only by “positive expansionary fiscal policy.”

The fundamental reason for India’s long-term external deficit lies in its economic structure rather than its policy. During specific time periods, especially the initial stage of a country’s modernization when large-scale imports of advanced international technologies are necessary, and the period when a country tries to realize leapfrog development by using second-mover advantages, trade deficit is good for a country. However, if trade deficit runs through the whole process of a country’s economic development, it becomes a problem that calls for structural adjustment rather than policy adjustment.

The problem of economic structure, if it is only a problem of industrial structure, can be solved through reform. However, if it is a problem of skeletal structure generated by relations of production which started to exist when the country began its construction, the structure cannot be changed after the country grows up, unless there takes place social revolution. Since the structure decides profits, it also decides a country’s development mode.

Profits Flow to Capital Centers

India’s financial deficit, international payments deficit, and trade deficit is long standing and continues to expand, which is quite different from the U.S. and Britain where similar situations also exist. The U.S. and Britain possess huge market potential and international market shares, their deficits can expand production scales in the next year, and help national wealth generate capitals for expanded reproduction in markets.

India is different. During its first two five-year plans, India imported a large quantity. However, these imports hadn’t been turned into capitals and production capacity, and the country failed to produce exports based on technology application and innovations in the next a few five-year plans. On this subject, readers can get a glimpse from the formation of India’s major import and export commodities.

India’s biggest increases on imports in the three decades were oil products which were in great need in the country and machines which contained comparatively advanced technologies. The increase in import of oil products was related to the oil crisis from late 1970s to early 1980s, and the 1990-91 Gulf War. And the increase in import of machines was related to India’s dependence on Western technologies. This dependence inevitably led to India’s import of high value-added products from the West and export of low value-added products, and caused price scissors.

From 1960s to 1990s, India’s largest exports in sequence were handicrafts including jewelry, textiles and garments, chemicals, engineering equipment, steel, construction machinery, leather and yarn and their finished products, and tea.

This situation showed that the industrial products India exported only carried low-end technologies. Export of low value-added products and import of high value-added products caused price scissors. And India’s long-standing and ever-expanding international payment deficit is the direct result of the international price scissors.

If we say that the price scissors between agriculture and industry during China’s planned economy period was for China’s primary accumulation for its basic construction, the long-existing price scissors between India and Western countries is a major manifestation of India’s profit-reverse cycle to the West in trade. During the seemingly equal exchange process, India has provided super profit to the West. This regurgitation-feeding to capital centers made India lose the potential for sustainable development and made its domestic market gradually shrink.

Nowadays, when people talk about India’s development potential, they always list a number of impressive statistics of India’s GDP growth rate in recent years, and try to prove that “it is still possible that India becomes a world economic giant in the first half of the 21st Century.” However, GDP growth isn’t everything. If GDP growth cannot be effectively transformed into national income and national wealth, then except maintaining employment, the growth may even cause harm to a country’s development.

The author is a professor with Strategic Studies Center, Beijing University of Aeronautics and Astronautics.